Das Thema Urlaubsrückstellungen kann Ihnen als verantwortlicher Mitarbeiter am Jahresende Schweißperlen auf die Stirn treiben. Denn: Das Jonglieren mit gesetzlichen Bestimmungen, individuellen Mitarbeiteransprüchen und dem Wunsch nach einer effizienten, präzisen Buchführung raubt vor allem eines: Zeit! In diesem Blogartikel tauchen wir tief in die Welt der Urlaubsrückstellungen ein und richten den Fokus dabei gezielt auf die Bedürfnisse von Finanzmitarbeitern. Wenn Sie sich mit den komplexen Berechnungen von Rückstellungen herumärgern und nach einem Werkzeug suchen, das diesen Prozess vereinfacht, sollten Sie auf jeden Fall weiterlesen.

Unter dem Begriff Urlaubsrückstellung versteht man eine präventive Maßnahme, bei der nicht genutzte Urlaubstage innerhalb eines Geschäftsjahres (Resturlaub) erfasst und bis zum Bilanzstichtag in Ihrer Jahresbilanz ausgewiesen werden.

Tritt der Fall ein, dass Ihre Arbeitnehmer ihren vollständigen jährlichen Urlaubsanspruch nicht im aktuellen Geschäftsjahr verbraucht haben, sondern ihn mit ins darauffolgende Jahr übertragen möchten, entsteht für Sie ein Erfüllungsrückstand. Falls Ihre Mitarbeiter noch nicht ihren Resturlaub für das neue Jahr eingereicht – also verplant – haben, handelt es sich hierbei um eine sogenannte „ungewisse Verbindlichkeit“. Diese unterliegt wiederum der Rückstellungspflicht gemäß § 249 HGB und erfordert die Bildung von Urlaubsrückstellungen.

Die Berechnung von Urlaubsrückstellungen können Sie unter Einbeziehung der handels- und steuerrechtlichen Vorgaben mithilfe verschiedener Methoden durchführen. Hierzu später mehr.

Das Handelsgesetzbuch verpflichtet Sie gemäß § 249 HGB zur Passivierung und damit zur Bildung von Urlaubsrückstellungen für offene Urlaubstage (Resturlaub) Ihrer Mitarbeiter. Darüber hinaus gilt laut § 5 (1) EstG (Einkommensteuergesetz) der Maßgeblichkeitsgrundsatz auch für Urlaubsrückstellungen. Neben allen gesetzlichen Verpflichtungen bieten Urlaubsrückstellungen auch Vorteile und Sicherheiten für Arbeitgeber als auch für Mitarbeiter.

Einerseits sichern Sie mit Urlaubsrückstellungen die rechtmäßigen Ansprüche Ihrer Mitarbeiter. Diese haben die Möglichkeit, nicht genutzte Urlaubstage im Folgejahr zu nehmen. Alternativ besteht die Option, sich den Resturlaub auch auszahlen zu lassen. Dies erweist sich besonders vorteilhaft bei einer Kündigung oder der Gefahr einer Insolvenz Ihres Unternehmens.

Für Arbeitgeber wiederum stellen die in der Bilanz ausgewiesenen Urlaubsrückstellungen eine effiziente Möglichkeit dar, den Überblick über sämtliche Urlaubstage Ihrer Belegschaft zu behalten. Dadurch können Sie Schlussfolgerungen für die mit dem Resturlaub verbundenen zukünftigen Aufwendungen ziehen und finanzielle Belastungen besser kalkulieren. Dieser klare Überblick ermöglicht Ihnen Vorteile in der Personalplanung. Die Kommunikation der verbleibenden Urlaubstage durch Urlaubsanträge an die Personalverwaltung im folgenden Kalenderjahr verhindert, dass die Resturlaubstage verfallen. Auf diese Weise erhalten Sie als HR-Verantwortliche einen präzisierten Einblick in die Kapazitätsplanung Ihres Betriebs.

Einfache Antwort: Ja! Denn in Deutschland besteht für Unternehmen die Verpflichtung, Urlaubsrückstellungen zu bilden, wenn Ihre Mitarbeiter den gesamten Jahresurlaub nicht vollständig nutzen (können). Die gesetzliche Grundlage hierfür findet sich in § 7 Bundesurlaubsgesetz (BUrlG). Gemäß dieser Regelung ist die Übertragung von Urlaubstagen in das neue Jahr nur unter bestimmten Bedingungen gestattet – grundsätzlich sollte der gesamte Urlaub im laufenden Kalenderjahr genommen und gewährt werden. Eine Übertragung von Resturlaub – und somit die Bildung von Urlaubsrückstellungen – ist lediglich bei persönlichen oder dringenden betrieblichen Gründen erlaubt. Liegen diese vor, sind Ihre Mitarbeiter dazu verpflichtet, den Resturlaub in den ersten drei Monaten des neuen Jahres zu nehmen. Aber Achtung: Resturlaub muss auch von Ihrem Betrieb in den ersten drei Monat gewährt werden!

Die Höhe der Urlaubsrückstellungen wird durch das Urlaubsentgelt Ihrer Mitarbeiter und die Anzahl der verbleibenden Urlaubstage bestimmt. Dieses Entgelt wäre angefallen, hätten Ihre Mitarbeiter den Urlaub tatsächlich genommen. Gemäß den Vorgaben des Handelsrechts handelt es sich dabei um zukünftige Personalaufwendungen, die Ihr Unternehmen im kommenden Geschäftsjahr zusätzlich tragen muss. Die Urlaubsrückstellungen berücksichtigen das Bruttoarbeitsentgelt, die Lohnnebenkosten sowie mögliche Gehaltserhöhungen oder Sonderleistungen, wie Urlaubs- oder Weihnachtsgeld.

Je größer Ihr Unternehmen, desto aufwändiger die Berechnung der Urlaubsrückstellungen für jeden einzelnen Mitarbeiter. Aus diesem Grund gestattet die Rechtsprechung die Berechnung von Urlaubsrückstellungen (§ 252 HGB) entweder als Individualberechnung oder als Durchschnittsberechnung. Bei der Individualberechnung ermitteln Sie die Urlaubsrückstellung für jeden einzelnen Mitarbeiter separat. Obwohl diese Methode präzise Ergebnisse liefert, ist sie bei einer größeren Anzahl von Mitarbeitern äußerst arbeits- und zeitaufwändig. In solchen Fällen bietet sich die Durchschnittsberechnung als Alternative an. Hierbei werden alle Mitarbeiter als Gruppe betrachtet, was den Arbeitsaufwand erheblich reduziert. Allerdings ist bei stark schwankenden Lohnstrukturen Vorsicht geboten, da die Gefahr von Über- oder Unterbewertung besteht!

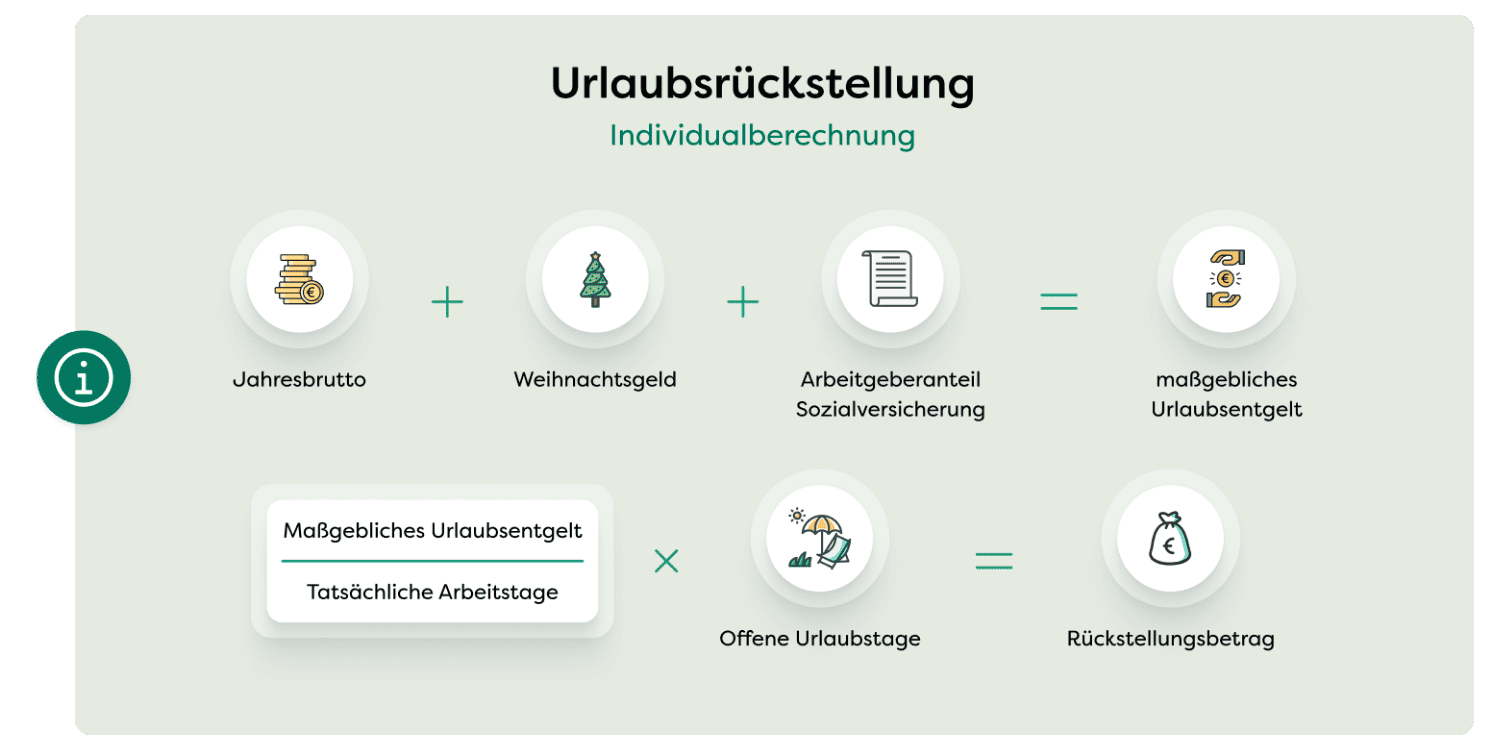

Mit der Individualberechnung erfassen Sie für die Berechnungsgrundlage der Urlaubsrückstellungen den Stundenlohn sowie das Arbeitszeitmodell jedes einzelnen Mitarbeiters. Urlaubstage, die Ihre Arbeitnehmer nicht in Anspruch genommen haben, werden auf Basis des Arbeitszeitmodells in Arbeitsstunden umgerechnet. Diese Arbeitsstunden werden anschließend mit dem Brutto-Stundenlohn des jeweiligen Mitarbeiters bewertet. Zusätzlich werden Ihre Arbeitgeberanteile zur Sozialversicherung hinzugerechnet. Auf diese Weise können Sie jeder Rückstellung einen monetären Wert – das maßgebliche Urlaubsentgelt – zuordnen. Die Individualberechnung ist daher sehr präzise, aber auch sehr aufwändig. Durch den großen Verwaltungsaufwand eignet sich diese Methode eher für Unternehmen mit einer überschaubaren Mitarbeiterzahl.

Klara Schneider erhält bei ihrem Arbeitgeber laut Arbeitsvertrag ein Jahresbrutto in Höhe von 40.000 Euro. Zusätzlich zahlt ihr Arbeitgeber ein Weihnachtsgeld von 2.500 Euro. Zur Berechnung des maßgeblichen Urlaubsentgelts werden zusätzlich den Arbeitgeberanteil für die Sozialversicherung und weitere Lohnnebenkosten hinzugezogen. Folgende Rechnung ergibt sich:

Gross annual salary: 40,000 euros

+ Christmas bonus: 2,500 euros

+ employer's social security contribution: 5,500 euros

= 48.000 Euro maßgebliches Urlaubsentgelt

Frau Schneider ist in Vollzeit bei ihrem Arbeitgeber angestellt und arbeitet an fünf Tagen pro Woche. Zieht man gesetzliche Feiertage ab, ergibt sich eine Summe von 248 tatsächlich geleisteten Arbeitstagen pro Jahr. Frau Schneider hat noch sechs Tage Resturlaub. Somit ergibt sich folgende Berechnung für die individuelle Urlaubsrückstellung:

Maßgebliches Urlaubsentgelt: 48.000 Euro

/ Tatsächliche Arbeitstage: 248

* Remaining holiday days: 6

= 1.161 Euro Rückstellungsbetrag

Die passive Urlaubsrückstellung – also der Rückstellungsbetrag – für Frau Schneider würde 1.161 Euro betragen. Die Finanzabteilung des Arbeitgebers ist verpflichtet, diesen Rückstellungsbetrag in der Steuerbilanz anzugeben.

Bei der Durchschnittsberechnung der Urlaubsrückstellung durchlaufen Sie ähnliche Schritte, ohne jedoch den Fokus auf jeden einzelnen Mitarbeiter zu legen. Stattdessen teilen Sie Ihre Mitarbeiter in Gruppen ein und nutzen die Durchschnittswerte der Stundenlöhne sowie Arbeitszeitmodelle. Die Berechnung erfolgt auf Basis dieser Gruppenwerte. Eine mögliche Grundlage für die Gruppierungen können Gehaltsstrukturen sein, wie beispielsweise Minijobber, Teilzeitkräfte oder Geschäftsführer.

Achtung: Diese Methode ist weniger präzise als die Individualberechnung und kann schnell zu Unter- oder Überbewertung führen. Trotzdem wird sie gerade in großen Unternehmen häufig angewendet, da sie durch den geringeren Verwaltungsaufwand effizienter ist.

Das Unternehmen Alleskönner GmbH hat vier Mitarbeiter und möchte nicht für jeden einzelnen Angestellten eine Individualberechnung der Urlaubsrückstellung durchführen. Um das maßgebliche Urlaubsentgelt zu berechnen, muss die Finanzabteilung die jährlichen Bruttolöhne, das Weihnachtsgeld sowie die Arbeitgeberbeiträge zur Sozialversicherung aller Mitarbeiter zusammenrechnen. Daraus ergibt sich folgende Berechnung:

Bruttogehälter: 270.000 Euro

+ Christmas bonus: 25,000 euros

+ employer's social security contribution: 28,000 euros

= 323.000 Euro maßgebliches Arbeitsentgelt für das gesamte Team

Um die tatsächlichen jährliches Arbeitstage der vier Mitarbeiter zu erhalten, multipliziert die Finanzabteilung der Alleskönner GmbH die Arbeitstage pro Woche mit 52. Abzüglich der gesetzlichen Feiertage pro Jahr ergibt sich daraus ein Wert von 996 tatsächlichen Arbeitstagen. Die Durchschnittsberechnung der Urlaubsrückstellung sieht für die vier Mitarbeiter so aus:

Maßgebliches Urlaubsentgelt: 323.000 Euro

/ Tatsächliche Arbeitstage: 996

* Remaining holiday days: 24

= 7.783 Euro Rückstellungsbetrag

Den Betrag von 7.783 Euro weist die Finanzabteilung der Alleskönner GmbH bei der Steuerbilanz entsprechend aus.

Jetzt sehen Sie sicher den Wald vor lauter Bäumen nicht mehr, richtig? Je nachdem, wie groß Ihr Unternehmen ist, ist die Berechnung der Resturlaubstage und Urlaubsrückstellung mehr oder weniger aufwändig. Damit Sie Ihre wertvolle Zeit nicht mit manuellen Berechnungen verbringen müssen, haben wir eine Lösung, die Sie bei der Berechnung von Urlaubsrückstellungen unterstützt. Mit den ZEP Zusatzmodulen Überstunden, Fehlzeiten & Urlaub and Prices & Receipts you not only save time, but also nerves when preparing your annual accounts.

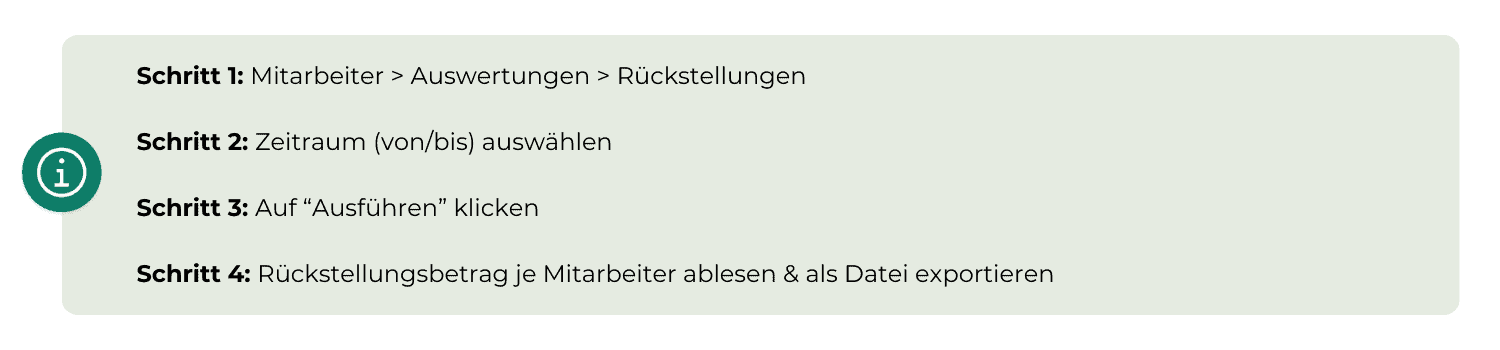

Denn: Mit dem Modul Preise & Belege (zusätzlich buchbar für ZEP Compact & already included in ZEP Professional) können Sie für jeden Mitarbeiter einen internen Stundensatz festlegen, der zur Berechnung des maßgeblichen Urlaubsentgelts verwendet wird. Und dank des Moduls Überstunden, Fehlzeiten & Urlaub werden Resturlaubstage sowie sämtliche gesetzlichen Feiertage für Ihr Bundesland exakt abgebildet. Hinterlegen Sie einfach in den entsprechenden Modulen alle benötigten Parameter, wie Jahresurlaub, Bruttolöhne, etc. und schon können Sie – mit der Kombination beider Module – die Urlaubsrückstellungen auf Knopfdruck für jeden Mitarbeiter individuell erledigen. Hierfür gehen Sie in Ihrem ZEP wie folgt vor:

Wie Sie sehen, gelangen Sie mit wenigen Klicks zur gewünschten Auswertung, können den Rückstellungszeitraum individuell auswählen und die Daten einfach exportieren und so bequem in Ihre Jahresbilanz übernehmen. Kleiner ZEP Hack: Sie können sich diese Auswertung auch automatisiert (in ZEP „Im Hintergrund ausführen“) in einem festgelegten Turnus zuschicken lassen.

Das ging Ihnen zu schnell und Sie möchten noch einmal tiefer in die Materie eintauchen? In unseren informativen Webinars on project time recording können Sie alle Fragen zur Urlaubsrückstellung stellen. Sie nutzen ZEP noch gar nicht, wollen aber gerade jetzt zum Jahresende die Urlaubsrückstellungen einfach erledigen? Unsere free trial version können Sie 30 Tage wie eine Vollversion mit allen gewünschten Modulen nutzen.

Read article ↗

How can you strengthen your employer brand and attract the best talent? Discover 11 effective employer branding measures that will help you stand out from the competition and optimise your recruitment strategy.

Read article ↗

We answer your questions quickly & competently. Contact us by phone or email.

+49 7156 43623-0 or contact form