Changes in 2024: The turn of the year will bring some significant adjustments, especially for employees. This affects various aspects, from the increase in the minimum wage to the expiry of the inflation compensation premium. Progress may also be on the horizon with regard to the obligation to record working hours. What changes will affect employees in 2024? What do you need to watch out for? We have summarised all the important changes for you.

As of 1 January 2024, the amount Minimum wage from 12 euros to 12.41 euros. This increase follows the Proposal of the Minimum Wage Commission. At the same time, the dynamic low income threshold will rise from 520 euros to 538 euros per month. This change will enable mini-jobbers to earn 18 euros more per month from next year without incurring additional social security contributions.

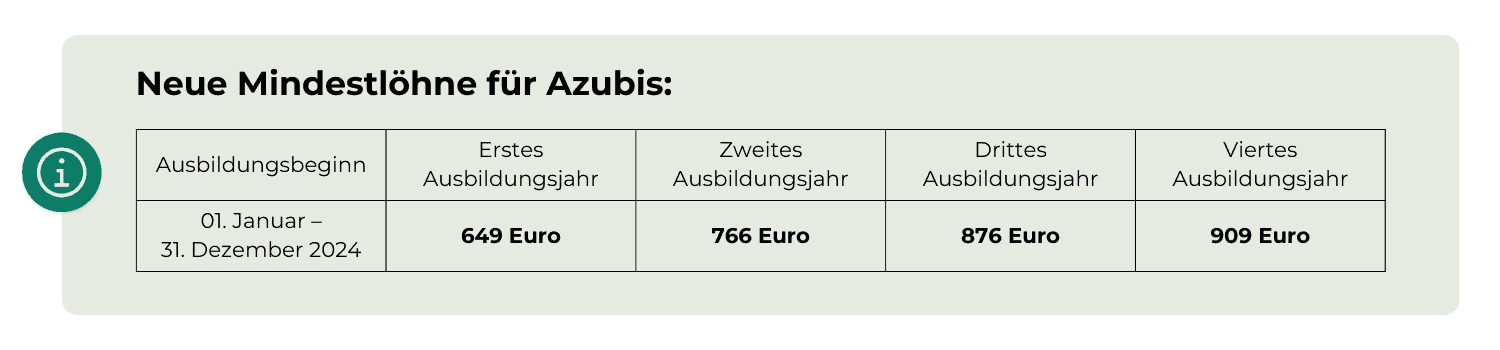

In 2024, the minimum wage for apprentices in their first year of training will also rise from 620 to 649 euros. These minimum wages are in the Vocational Training Act (BBiG) which was introduced in 2020 and applies to trainees in companies without collective bargaining agreements. Since its introduction, the minimum wage for trainees has been adjusted every year - and will continue to be increased in 2024.

The FDP and the business community are calling for further flexibilisation of working hours. In this context EU Working Time Directive which provides for a maximum weekly working time. Compromises could be found in the form of a temporary extension of maximum working hours on a voluntary basis; at the same time, this could pave the way for adjustments to the labour law. Working Hours Act and Regulations on recording working hours pave the way.

When the special coronavirus rules expire at the end of 2023, the regular number of child sickness benefit days per year will return. The Nursing Studies Strengthening Act provides for an increase in the entitlement to child sickness benefit days for the years 2024 and 2025. The following regulations therefore apply with immediate effect:

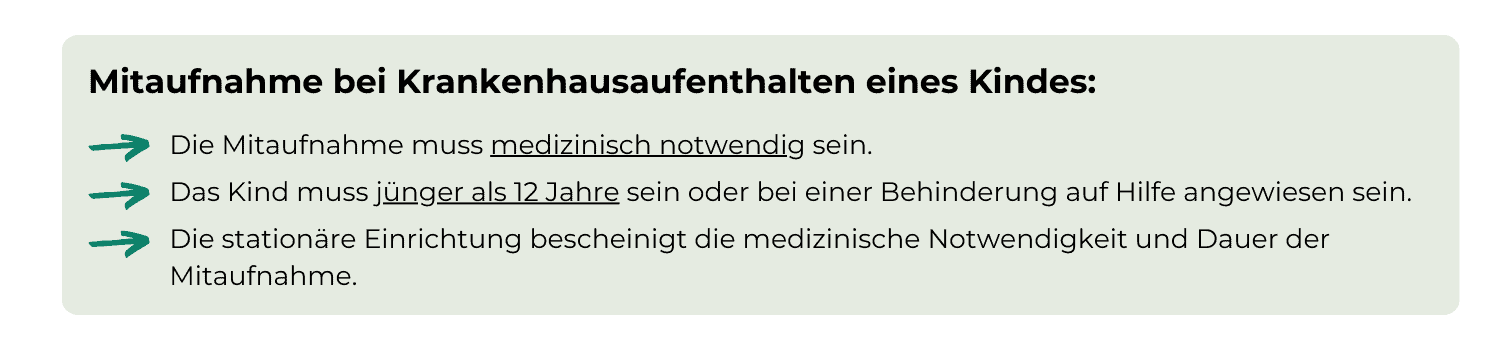

Another new feature is the possibility of receiving child sickness benefit if the sick child is admitted as an inpatient. According to the law, this entitlement exists for the entire duration of the co-admission, without a fixed maximum entitlement period. Important: These days are not counted towards the regular child sickness benefit days!

The entitlement applies under the following conditions:

Provided the Mediation Committee agrees to the Growth Opportunities Act, there will be higher tax-free lump sums for additional subsistence expenses for business trips from 2024. These will amount to 16 euros (instead of the previous 14 euros) for the day of arrival and departure and 32 euros per day (instead of the previous 28 euros) for trips lasting several days. The flat rate for days with an absence of more than eight hours is also 16 euros. There is currently a government draft that calls for an increase to 15 euros and 30 euros respectively.

It should be noted that the meal allowance is only reimbursed in full if the business traveller pays for the meals themselves. If meals are paid for by the employer, the expense rate is reduced accordingly. Employees should therefore document their expenses precisely and keep all receipts in order to take advantage of tax benefits.

At September 2022, the Federal Labour Court ruledthat the recording of working hours is mandatory for most German employees. Despite this decision and the coalition partners' intention to revise the legal basis for recording working hours, few concrete steps have been taken to date.

A first Draft law from April 2023 is available, but disagreements within the governing coalition over exemptions and flexibility in working time recording have delayed progress to date. The legal regulation of working time recording therefore remains an open issue that may be advanced in 2024.

The federal government's third relief package, which was adopted in September 2022, enables companies to offer their employees a Tax-free inflation adjustment premium (IAP) of up to 3,000 euros. Payment is possible in the period from 26 October 2022 to 31 December 2024.

Companies can decide for themselves whether to utilise the full amount and whether to transfer the benefits all at once or in several tranches. Benefits in kind are also permitted, but there is no obligation to pay the inflation compensation premium.

Read article ↗

How can you strengthen your employer brand and attract the best talent? Discover 11 effective employer branding measures that will help you stand out from the competition and optimise your recruitment strategy.

Read article ↗

We answer your questions quickly & competently. Contact us by phone or email.

+49 7156 43623-0 or contact form