Freelancers that you engage for specific projects are an extremely valuable resource for your company and the success of your project. Thanks to their special skills and flexibility, they can effectively complement your permanent employees. However, freelancers differ significantly from permanent employees in terms of labour law.

In this blog article, we explain the sectors in which they are most frequently used, the differences to permanent employees and what you as an employer or client need to be aware of when it comes to bogus self-employment.

Freelancers differ from permanent employees as they are independent business partners who accept orders from your company. The collaboration is not based on an employment contract, but on a fee contract, service contract, work contract or a combination of these contractual forms.

As a rule, freelancers work with different clients at the same time and make independent decisions about which assignments they wish to accept. They are not subject to the social security regulations for employees, but must take care of their health insurance or pension themselves. It is also the responsibility of a freelancer to pay taxes on their income independently.

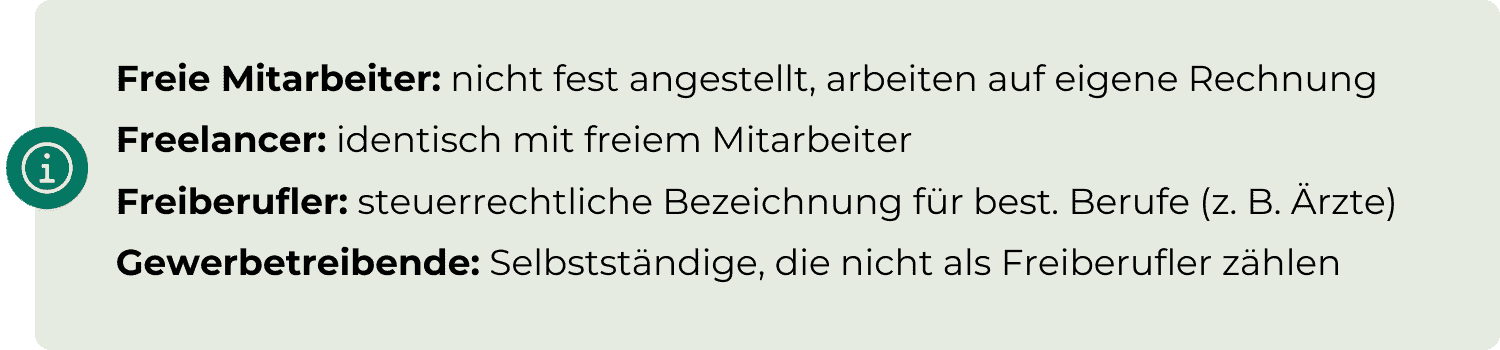

The difference between a freelancer and a freelancer is purely linguistic. Both terms refer to the same thing: a temporary employee who works independently. The choice of term varies depending on the industry, with freelancers being used more frequently in the media, design and advertising sectors. Lawyers, doctors and lecturers, on the other hand, tend to favour the term freelancer.

The term "freelancer" has a tax law meaning. This is because, although freelancers are self-employed, not every self-employed person is taxable according to § Section 84 (1) of the German Commercial Code automatically classified as freelancers. The clear definition is provided by tax law, in particular by § Section 18 of the Income Tax Act. Certain professional groups such as doctors, midwives, Lawyers, tax consultantsarchitects and Engineers are clearly considered freelancers and are therefore not subject to trade tax.

In areas such as IT services or Agencies some tax offices categorise self-employed persons as tradespeople rather than freelancers. For example, if IT specialists work exclusively as lecturers for several institutions, they can claim freelancer status. However, an IT expert who advises companies on how systems and security precautions need to be taken is recognised as a tradesperson and must also register this trade with the relevant office.

Freelancers are usually employed for a limited period of time for specific projects. In the IT sector, the use of freelancers has been established for years. For example, an experienced programmer can be involved in the development of new software at various companies for several months within a year.

However, freelancers are also involved in various consulting functions - from such as the management consultancy - active. They are also frequently found in the media industry. In this context, many newspapers are increasingly relying on a small permanent editorial staff and source articles or reports from freelance editors.

Compared to permanent employees, freelancers enjoy less legal protection. While they do not receive continued pay in the event of illness and are not paid during holidays, their contractual commitment is usually limited to one project. The due date and amount of the remuneration, which is referred to as a fee or salary depending on the industry, is based on the individual contract. Health insurance must also be taken into account. Freelancers are not automatically covered by statutory health insurance. Here there is the option of voluntary contributions to health insurance funds. If freelancers are used in your company, you should consider how they differ from your permanent employees:

- Social securityFreelancers pay these independently.

- Working hoursFreelancers can generally organise their own time - independent of company working hours.

- Protection against dismissalThere is no such provision for freelancers. All regulations in the event of termination are set out in individual contracts.

- PrioritiesAs a client, you must expect that you will not always have first priority with a freelancer. Especially if the freelancer has several clients at the same time.

Do you have a specific project for which you would like to commission a freelancer? You can benefit from this collaboration:

- Project planningFreelancers are particularly useful when you need additional staff or specialised skills for large and important projects. External freelancers can join the team for the duration of the project and contribute to the project's success during this period.

- Cost efficiencySince freelancers are not employees, you do not have to pay social security contributions, as is the case with permanent employees. This means that a freelancer can be more cost-effective for your company than a permanent employee.

- FlexibilityIn the case of freelance work, there is generally no right to a period of notice, which makes it possible to terminate the collaboration at short notice.

As an employer, you can benefit from the fact that freelancers can quickly familiarise themselves with new tasks and achieve a high level of productivity within a short period of time. In addition, they often have a wealth of experience due to their involvement in various projects. Freelancers are experts in a specific field, which you can utilise for clearly defined tasks within your project. A higher fee should not put you off, as this can certainly pay off. Due to the strong competition among freelancers, you can also expect a high level of performance.

If the freelancer does not work directly in your company, but with your own infrastructure, you have a considerable cost advantage here, as you do not have to provide computers, telephones or office space.

As we know, there are two sides to every coin, so working with freelancers can also have disadvantages for you as a client:

- AvailabilityFreelancers usually work for different clients. This may mean that their availability is not automatically guaranteed for your assignment. It may be the case that a freelancer who has already proven themselves has no capacity for the next project and you therefore have to fall back on an alternative.

- FamiliarisationEvery freelancer is an expert in their field, but working methods can vary greatly between companies. Therefore, each time you work with a new freelancer, you will need to explain your working methods again in order to achieve an optimal project result.

- Team spiritFreelancers who come and go regularly are often not fully integrated into your team. This can affect the working atmosphere and lead to a lack of a strong sense of belonging. Resources invested in integrating freelancers could also be used to strengthen the loyalty of your permanent employees.

A certain level of trust is essential for successful collaboration with freelancers, as they often gain extensive insights into your company. A confidentiality clause in the cooperation agreement creates security here.

How is bogus self-employment defined? The German Pension Insurance writes about this:

"Pseudo-self-employed workers are persons who formally appear to be self-employed (contractors), but are actually dependent employees within the meaning of the § Section 7 (1) SGB IV are."

An example of bogus self-employment could be the following case:

"Annika works as a graphic designer and has worked exclusively for a design studio for several years. Although Annika formally acts as a self-employed freelancer and concludes fee-based contracts with the design studio, her way of working and her dependence on the studio fulfil the criteria of bogus self-employment.

Annika works exclusively on her client's premises, uses their computers and software, follows the studio management's work instructions and is integrated into the studio's fixed working hours. Although she is formally self-employed, the actual organisation of her work reflects that of a permanent employee.

In this case, German pension insurance could categorise Annika's work as bogus self-employment. This would have serious legal consequences for both Annika and the design studio."

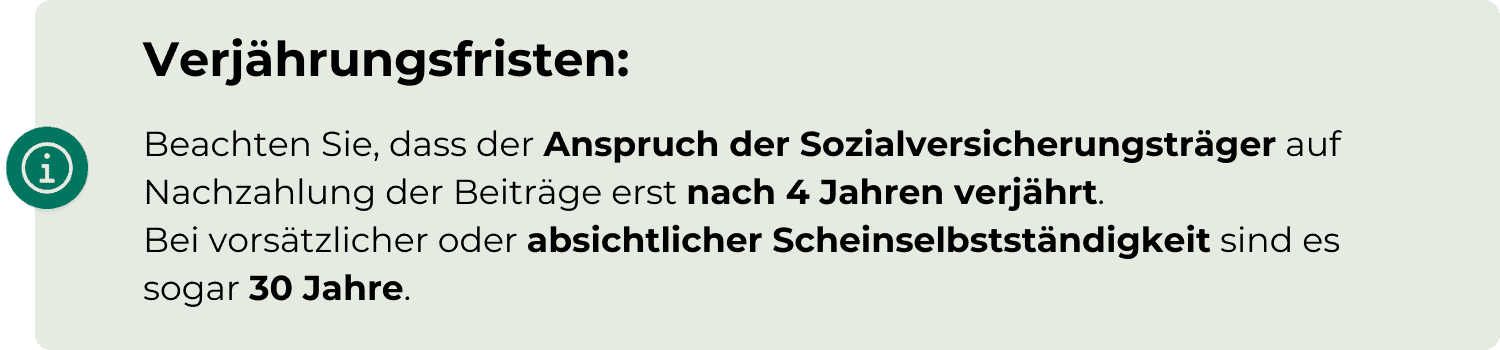

If bogus self-employment is established, both the contractor classified as bogus self-employed and you as the client face financial consequences and possible penalties.

As a rule, both parties are requested to retroactively pay all contributions to statutory pension, health, long-term care and unemployment insurance. The consequences can be life-threatening, depending on the duration and amount of the unpaid social security contributions.

In addition, there may be consequences under criminal law. According to § 266a StGB a fine or prison sentence can be imposed for social security fraud if intent is proven. This applies in particular if the sole purpose of the employment relationship was to save social security contributions or if the bogus self-employed person received social security benefits at the same time.

If you employ a bogus self-employed freelancer, there are legal consequences for you as the client. Not only do you have to pay social security contributions and wage tax, but the self-employed person also becomes an employee with all the associated rights, including protection against dismissal, holiday entitlement and the obligation to continue to pay wages. The tax office can demand retrospective wage tax back payments for up to four years.

Please note: Fines and even prison sentences can be imposed in the event of proven intentional bogus self-employment.

You should decide whether to integrate new team members into your company as freelancers or permanent employees depending on your needs. In the long term, the combination of freelancers and permanent employees could be the optimal solution. If you decide to use freelancers in your company on a regular basis, efficient collaboration is crucial. Our ZEP software offers you the opportunity to simplify this collaboration by working together with your freelancers in one tool. With the Additional module for freelancers you can pay out the recorded time expenditure directly as credit notes.

ZEP offers you a wide range of features that are tailored to the needs of working with freelancers. These include the labelling of employees as freelancers and the option of selecting whether a freelancer should issue invoices or receive credit notes. The option of storing internal hourly and daily rates for each employee and adapting these to specific projects gives you maximum flexibility in the fee structure. ZEP also provides a comprehensive analysis that gives you an overview of credit notes that have already been issued.

The credit note procedure makes billing much easier for your accounting department. The direct payment of recorded time and effort saves you the complex invoicing process. And this is how easy the credit memo procedure works:

1. Creation & storage of credit notes: Based on the recorded time bookings, you can quickly and easily create credit notes for your freelance employees. These are stored securely and clearly in ZEP.

2. Configuration of VAT & currency: Customise the VAT and currency for each credit note to meet the legal requirements and the needs of your freelancers.

3. Automatic numbering: ZEP enables the automatic numbering of credit notes in a configurable format, which makes administration and tracking much easier.

With ZEP, you can make your collaboration with freelancers transparent, efficient and legally compliant - so that you can concentrate on the essentials: the success of your projects.

Read article ↗

Read article ↗

We answer your questions quickly & competently. Contact us by phone or email.

+49 7156 43623-0 or contact form